Whether you provide benefits currently, or plan to provide them in the future, you need to know how to assess these benefits to ensure you’re doing what you need to for your employees, without paying more than you should.

As business owners, we often avoid obtaining information about insurance and financial planning because there are too many providers to choose from and we’re concerned that we’ll be sold something we don’t need. So I’d like to give you some useful information to help you with your decision making process.

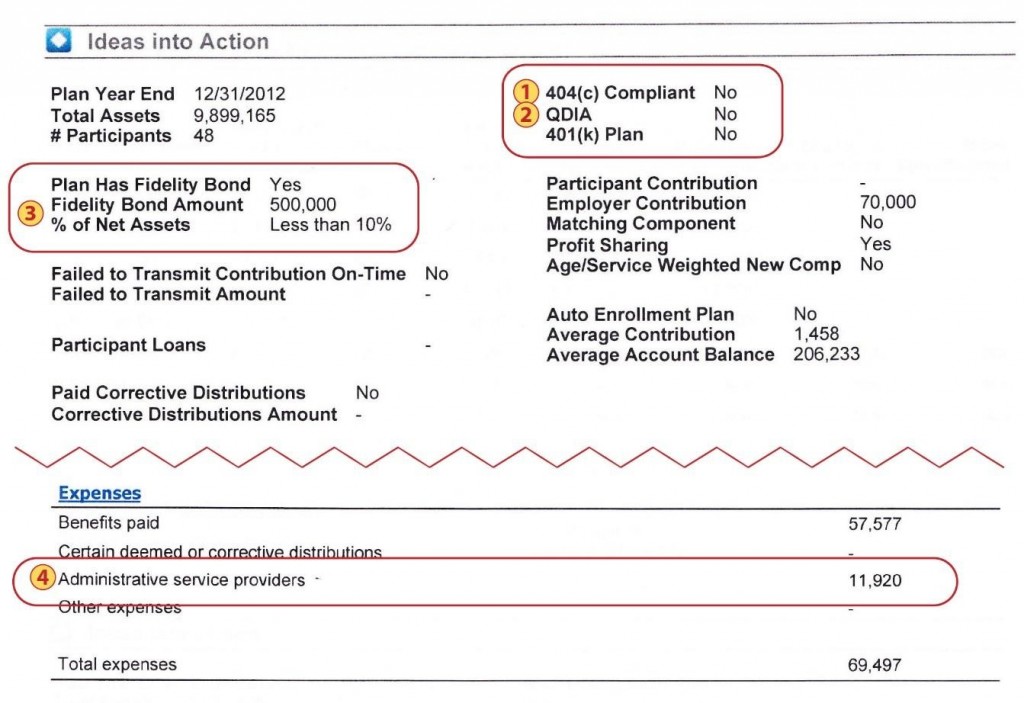

To start you want to take a look at your statement from your current provider to…

● Make sure you are paying what you should be.

● Ensure you’re in compliance.

Here are some examples from a variety of manufacturers:

- 404c compliant – not the case

- QDIA – not the case

- Sufficiently bonded – less than 10% bonded

- Fees that are the norm – could be questioned

What does all this mean?

The bottom line is, if your plan is not following the guidelines set by the Employee Retirement Income Security Act (ERISA) you open yourself up to loss of income and possibly a lawsuit.

- 404c compliant – ensures that you’re doing what you should for your employees (ex: having the same investments for everyone regardless of age would be a problem)

- QDIA – (Qualified Default Investment Arrangements) – make sure that employee dollars are invested in an appropriate program.

- Sufficiently bonded – the bond should be greater than 10%

- Fees that are the norm – these may be buried in the plan and you may not be aware of them

What Do I Do?

We can help you get a free plan review. We have vetted financial advisors who will perform an account review, free of charge. If you prefer not to meet in person, they can pull the public information about your site and review it over the phone. If everything looks good, they will let you know. If there’s a “red flag” they will let you know that as well. You are under no obligation to transfer you plan to them. This is simply a way to make sure that you’re paying what you should be and that your plan is compliant.

Contact Us at 860-432-9977 for your piece of mind.